Staying current with tax regulations is vital for precise payroll management. This guide explores the Fortnightly Tax Table effective from 1 July 2024, offering a comprehensive approach to calculating withholding amounts. It includes procedures for handling various payment types such as salaries, allowances, and special payments like paid parental leave and directors’ fees.

The guide also addresses special cases, including foreign residents and specific worker categories, and outlines steps for using the tax table, including adjustments for Medicare levies and study loans. It highlights upcoming tax changes, provides a detailed tax rate structure, and offers instructions for downloading the updated Fortnightly Tax Table PDF. Accurate withholding ensures compliance and effective tax management for all employee payments.

Table of Contents

What Is Fortnightly Tax?

Fortnightly tax refers to the system of calculating and withholding income tax from payments made on a fortnightly basis, which means every two weeks. In Australia, this typically applies to regular payments such as salaries and wages. To explain how it works, here it is:

- Fortnightly Payments: Employees or contractors who receive payments every two weeks are subject to fortnightly tax withholding. This means that the tax is calculated based on their earnings over each two-week period.

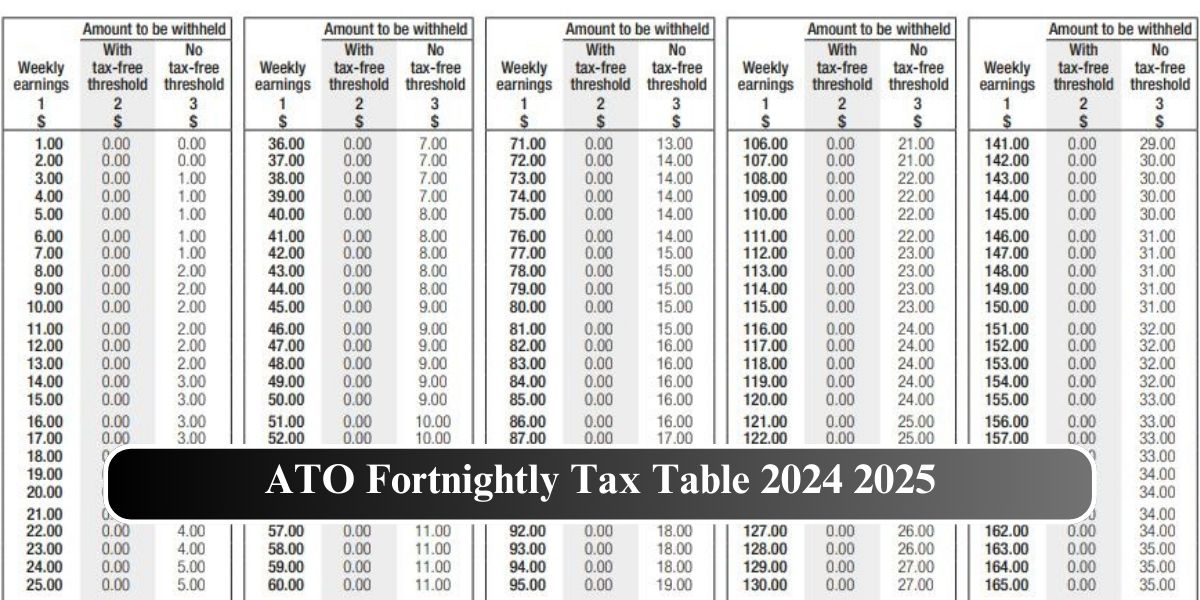

- Tax Tables: The Australian Taxation Office (ATO) provides specific tax tables that employers use to determine how much tax should be withheld from each fortnightly paycheck. These tables are updated periodically to reflect changes in tax laws and rates.

- Withholding Calculation: To calculate the correct amount of tax to withhold, employers use the Fortnightly Tax Table to look up the withholding amount based on the employee’s earnings and any other relevant factors such as tax-free thresholds or tax offsets.

- Special Cases: The Fortnightly Tax Table may also account for special cases, such as payments to foreign residents, specific allowances, and other types of income that may require different tax treatment.

Overall, fortnightly tax ensures that employees have their tax liabilities spread out evenly over the year, with taxes withheld regularly from their paychecks.

| Facebook Settlement Payout Date |

| $750 Stimulus Checks |

| $528 Stimulus Check |

| Ssdi Ssi Va Stimulus Check |

| $9000 Stimulus Checks |

Fortnightly Tax Table 2024-2025

Understanding the Fortnightly Tax Table

The Fortnightly Tax Table applies to various payments made on a fortnightly basis, including:

- Salary, wages, allowances, and leave loading

- Paid parental leave

- Directors’ fees

- Members of government, people with statutory offices, people in the defense force, and police officers get paid and get extra money for their jobs.

- Payments to labour-hire workers

- Payments to religious practitioners

- Government education or training payments

- Compensation, sickness, or accident payments made periodically

It is also applicable for payments made to foreign residents. However, different tables may be required for specific groups such as shearers, horticultural workers, and performing artists.

For those employing individuals on a working holiday maker visa, refer to Schedule 15 – Tax Table for Working Holiday Makers.

Using the Tax Table

Calculation Steps

- Calculate Total Fortnightly Earnings: Combine regular earnings with any allowances and irregular payments, rounding down to the nearest dollar.

- Use the Withholding Lookup Tool: Input the earnings into the Withholding Lookup Tool to determine the withholding amount. For employees:

- Claiming the tax-free threshold: Use Column 2.

- Not claiming the tax-free threshold: Use Column 3.

- Apply Tax Offsets: If applicable, use the Ready Reckoner for Tax Offsets to adjust the withholding amount.

- Medicare Levy Adjustments: Subtract the Medicare levy adjustment amount if necessary.

- Study and Training Support Loans: Add any amounts for student loans as indicated in the Study and Training Support Loans Fortnightly Tax Table.

Example Calculation

For an employee with fortnightly earnings of $989.80:

- Input $989 into the Withholding Lookup Tool.

- If claiming the tax-free threshold, withhold $42.

- If not claiming, withhold $188.

Managing 27 Pays in a Financial Year

In some years, with 27 pays instead of 26, there might be insufficient withholding. Inform your employees of this possibility and adjust withholding by the following amounts based on earnings:

| Fortnightly Earnings ($) | Additional Withholding ($) |

|---|---|

| 1,750 to 5,149 | 12 |

| 5,150 to 7,249 | 26 |

| 7,250 & over | 47 |

Using Formulas for Withholding

If using custom payroll software, refer to Schedule 1 – Statement of Formulas for calculating amounts to be withheld.

Handling Tax File Number (TFN) Declarations

The TFN Declaration determines the withholding amount. If an employee fails to provide a valid TFN, withhold:

- 47% for resident employees

- 45% for foreign residents

If a TFN is not provided within 28 days of application, the above withholding rates apply unless instructed otherwise.

What will the Australian Tax Office (ATO) rates be in 2025?

For Australian residents, the tax rates from 2020 to 2025 are structured as follows:

- Income up to $18,200: No tax is payable.

- Income from $18,201 to $45,000: A tax rate of 16 cents per dollar applies to amounts over $18,200.

- Income from $45,001 to $135,000: A base tax amount of $4,288 is payable, plus 30 cents for every dollar above $45,000.

- Income from $135,001 to $190,000: A base tax amount of $31,288 is payable, plus 37 cents for every dollar above $135,000.

The amount withheld from an employee’s pay can differ based on whether they have chosen the tax-free threshold. Below, we’ve provided the fortnightly tax table for your convenience.

| Earnings | Tax-Free Threshold | No Tax-Free Threshold |

|---|---|---|

| $100 | $0 | $18 |

| $300 | $0 | $62 |

| $500 | $0 | $110 |

| $724 | $2 | $162 |

| $1000 | $66 | $224 |

| $2000 | $324 | $566 |

| $3000 | $670 | $912 |

| $5000 | $1378 | $1650 |

| $6550 | $1982 | $2282 |

We have provided a list of various earnings along with the corresponding amounts that employers are required to withhold. Employers should use this information to calculate the appropriate deductions before disbursing payments to employees and other associates.

What are the tax changes for Australia in 2024?

Starting from 1 July 2024, several tax adjustments are planned:

- The 19% tax rate will be lowered to 16%.

- The 32.5% tax rate will be reduced to 30%.

- The threshold for the 37% tax rate will increase, meaning it will only apply to incomes over $135,000 instead of $120,000.

Managing Study and Training Support Loans

For employees with HELP, VSL, FS, SSL, or AASL debts, calculate additional withholding based on the Study and Training Support Loans Fortnightly Tax Table.

Special Cases

Allowances

Add allowances to normal earnings to calculate the withholding amount. For more information, refer to Withholding for Allowances.

Holiday Pay and Leave

Include holiday pay and long service leave in normal earnings for continuing employees. For lump sum payments on termination, refer to Schedule 7 and Schedule 11.

Leave Loading

For leave loading paid as a lump sum, use Schedule 5. For pro-rata payments, add it to earnings for the period.

Withholding Declarations

Employees can use Withholding Declarations to claim tax offsets or report changes affecting withholding. Changes include residency status, claiming tax-free thresholds, and debts.

Claiming Tax Offsets

Use the Ready Reckoner for Tax Offsets to calculate fortnightly values. Adjust withholding amounts accordingly. Foreign residents cannot claim tax offsets.

Foreign Residents

For foreign residents:

- Without a valid TFN: Withhold 45% of earnings.

- With a valid TFN: Use the Foreign Resident Tax Rates.

Foreign Resident Tax Rates

| Fortnightly Earnings ($) | Rate |

|---|---|

| 0 to 5,191 | 30% |

| 5,192 to 7,305 | $1,557 plus 37% over $5,191 |

| 7,306 & over | $2,339 plus 45% over $7,305 |

What is the current Australian tax rate table?

For the 2024–25 financial year and beyond, Australian income tax rates for residents are as follows:

Here’s a table representing the provided tax brackets and rates:

| Income Range (USD) | Tax Rate |

|---|---|

| $18,201 – $45,000 | 16% |

| $45,001 – $135,000 | 30% |

| $135,001 – $190,000 | 37% |

| Above $190,001 | 45% |

How to Download the 2024-2025 Fortnightly Tax Table PDF

To download the Fortnightly Tax Table PDF, follow these steps:

- Use a compatible web browser on your device.

- Visit the Australian Taxation Office’s official website.

- Navigate to the ‘Tax Professionals’ tab in the main menu.

- Under the dropdown menu, select ‘Tax rates & codes’ from the ‘Key Links’ section.

- On the subsequent page, look for ‘Tax Tables’ and find the link for the ‘Fortnightly Tax Table’.

- Click the link for opening the page with the option to download PDF.

- Scroll down to find and click on the PDF link to access the document.

By following these instructions, you can easily locate and download the PDF file for the Fortnightly Tax Table.

Or you can directly download the ATO Fortnightly Tax Table 2024-2025 PDF from here.

| $1200 Stimulus Check 2024 |

| $12000 Stimulus Checks 2024 |

| Lump Sum Social Security Payment |

| Minimum Social Security Benefit |

| $4873 Social Security Payment |

Final Words

Accurate withholding is essential for compliance and proper tax management. Use this guide to navigate the Fortnightly Tax Table effectively and ensure correct withholding practices for various employee payments.

For additional tools and resources, visit the Withholding Lookup Tool to quickly work out the amount to withhold.

FAQs

How do I calculate the withholding amount for an employee claiming the tax-free threshold?

To calculate the withholding amount for an employee claiming the tax-free threshold, follow these steps:

1. Calculate Total Fortnightly Earnings: Add up the employee’s regular earnings, allowances, and any irregular payments, rounding down to the nearest dollar.

2. Use the Withholding Lookup Tool: Input the total amount into the Withholding Lookup Tool.

3. Determine the Withholding Amount: Refer to Column 2 in the tax table for employees claiming the tax-free threshold. The tool will show you the exact amount to withhold based on the earnings.

What should I do if my employee has a HELP debt?

If your employee has a HELP, VSL, FS, SSL, or AASL debt, you need to withhold additional amounts based on their debt. Here’s how to manage it:

1. Refer to the Study and Training Support Loans Fortnightly Tax Table: Find the amount to be withheld based on the employee’s debt.

2. Add the Amount to Withholding: Add the additional withholding amount for the debt to the amount calculated from the Withholding Lookup Tool.

What happens if an employee does not provide a valid Tax File Number (TFN)?

If an employee does not provide a valid TFN, you must withhold:

1. 47% from payments made to a resident employee

2. 45% from payments made to a foreign resident employee

These rates apply if the employee has not claimed an exemption or advised you that they have applied for a TFN. If the TFN is not provided within 28 days of application, continue withholding at these rates unless otherwise instructed.